What is $200 to you?

To a wealthy person, it is probably loose change. On the other end of the spectrum, the same amount could very likely feed an entire family for a month.

Money has always been a concern in our lives. After all, it is the only tangible currency that dictates our lifestyle. That is, unless you lead an ascetic life.

For average citizens like you and me, the ever increasing costs of living in Singapore continues to be a worry and that little voice nagging at the back of our minds every time we spend.

A lot of us also grapple with the fear of not being able to ‘afford our life' when we grow old, frail, and sickly. But when I look at how our mothers (and fathers) have saved up very decent (five-figure) sums of money not just for themselves but also for us, their children, it makes me wonder: How the heck did they do it?

Considering the circumstances in which our parents grew up made me genuinely wonder why we struggle with finances now. With the generally lower income they would have drawn compared to our salaries today, it should not be too difficult for us to achieve the same kind of financial stability and still lead a fairly comfortable lifestyle, right?

Maybe not.

Being Barely Financially Literate

Awhile back, I penned my thoughts on my future in Singapore, where I shared the fears I have and the uncertainty of whether I’d be able to afford (a graceful) retirement in Singapore. To which I believe is the same concern felt by many Singaporeans.

Over the last couple of months however, life milestones like marriage and home ownership has made me realise how clueless I had been with money.

Yes, of course. There are many factors to consider. Our policies, the ten-fold increase in housing prices, and inflation are all changes that has made it more challenging for us. But these are all areas that we have no control over, and are complex topics to debate over as itself.

On a more personal level, I have come to realise how little we know about money and affordability in our day-to-day lives.

“What does it mean to live within our means?”

It's a question that is so important, yet so hard to answer.

A lot of us spend based on our whim and fancy, not caring too much about whether we can afford it or not. Or rather, we spend based on a very vague assessment of whether we will be able to afford our meals (and necessities) for the rest of the month without going ‘broke’.

The problem with this is that when you add personal desire into the equation, you can bid logic and pragmatism goodbye.

Take for instance how we will usually avoid spending more than $20 on a meal, but we wouldn’t hesitate to spend $200 on a ticket to watch our favourite artiste live in concert.

It's exactly what 29-year-old Zafirah would do. $200 can be used to finance two to three weeks worth of her expenses, but like many Singaporeans, her spending is also very sporadic. As another millennial I spoke to explained, the amount he spends “is totally proportionate to how much of a life I have that week.”

Image Credit: Zafirah

While Zafirah avoids spending too much on lunches, she is willing to splurge on special occasions like birthdays and anniversaries, as well as concerts of her favourite artistes and on holidays.

“Beyond the price I look more at whether it's value-for-money. Even if I splurge or 'go big', I try to find vouchers and promos to reduce my spending. Like right now, I'm eyeing the Dyson Airwrap but I just can't justify spending $600 on a hairdryer.”

Value Is Arbitrary

All of us attach a different value to the same amount of money, and even on the same amount of money, we perceive value differently based on context.

Take for instance a literal comparison of apple to apple. $5 apples Vs. $55 premium apples. The $50 difference is a lot for fruits. However, $50 is not that big of a deal if you’re comparing long-haul flight tickets, and nothing when you’re looking at housing prices.

There are also those who end up being in debt for years after spending a bomb on achieving their dreams, like a dream wedding—a once in a lifetime affair. A 2016 TNP article shared the struggles faced by a couple who spent $110K on their big day, which left them with a four-year debt.

Is the $110k considered affordable or not then?

Because the value of money is so intangible, it is very hard not to have a biased perception of value, which makes it very hard to discern whether one can really afford something or not. Personal preference, the context of which we're spending, and our earning power all affects our perception of value.

GIF from <a href="

GIF from GIPHY

With plenty of payment options and interest-free instalment plans easily available today, the line between affordable and not over-budget isn't clear anymore. We’d all like to think that we are sensible enough to know what we can and cannot afford. But we probably don’t.

We spend on our whim and fancy because there has never been immediate pressure for us to save. For the majority of us, it is a fact that we have lived a sheltered life and never faced a real fear of not having enough to get through another day.

Financial literacy isn’t natural to us either. The only thing we’ve been taught is to save for a rainy day, period. As we grow older, we just grasp for information in the dark, trying to find out about the best savings account and plans, and financial planning tips through Google, friends, financial advisors, and through trial and error.

It’ll Take A Big-Ticket Item To Jolt Us Awake

In our daily lives, we often blurt out the occasional “I can’t afford this.” But I’d make the bold claim that one will only truly know what one can or cannot afford when faced with either having to pay off student loans independently, or when one is getting married and buying a house.

From young, my mother has always stressed this to me: Every dollar counts. When I started working however, I began to lax on that principle. The liberating freedom of seeing 4-figure amounts deposited into my bank account every month gave me the false impression that I can afford luxuries.

There’s always that tiny voice at the back of my head that continues to make me feel guilty for splurging, but on most occasions, the lure of gratification is way too enticing, especially when it comes to food. Not forgetting the FOMO on trends: the seasonal McDonald's burgers, the carnivals, the countless new bubble tea brands in Singapore, and basically anything that's on everyone's Instagram at any certain period of time.

The scariest part is when everything is digital, because it is way too easy to just swipe the card and worry about the money later.

Honestly, it is only after having to pay for a wedding banquet and a house that made me truly realise how careless I have been with my money. And this is probably the same for many of us and going to be the same for many more of us.

It is when you put things into perspective, like how the bill of a wedding banquet alone can be 20 to 30 months of your take-home pay, when you realise how f**ked you are in terms of your finances.

Until then, enjoy all the little luxuries while it lasts.

This is not a sponsored post.

Also read: Are Young Couples Jumping Onto The BTO Bandwagon Too Soon?.

(Header Image Credit: Fabian Blank on Unsplash)

First comes the proposal, then the wedding, and then the house. This was once the norm, but not anymore.

In Singapore, when you’ve been in a relationship for a reasonable amount of time, you can expect your partner to ask you one crucial question: “Want to BTO?”

Today, many couples apply for a BTO (Build-To-Order) flat before proposing. Marriage comes a little later, and it can happen before or after getting the keys to their home.

Logically, it makes more sense. It's pragmatic, as the wait for a BTO can be (dreadfully) long. The completion of BTO projects can take around 2.5 to 5 years. And let’s face it. Getting a house in Singapore is stressful. In fact, it’s downright terrifying.

It doesn’t matter if you’re in a relationship or if you’re single, buying a house here is crazy expensive despite the various grants available. It’s also incredibly difficult because you’re competing with hundreds of other buyers bidding for the same flat you wish to get. And when you are getting something which you will most likely have to continue paying for for the next 20 to 30 years, you can expect everyone to 'fight' for their ideal choice.

This competitiveness for a BTO forces many young Singaporeans to commit themselves into a relationship when they may not exactly be ready.

THE PRESSURE TO FIND LOVE FASTER

Because of the amount of time it takes for you to successfully get the keys to your new home, it means having to find the person you are 'meant to be with' a lot faster.

I know of singles in their mid 20s who are still working on finding the right person to date, let alone have a relationship with.

Dating itself has become a more daunting task than before. From the get-go, we start thinking about whether we see a future with this person, because we no longer have time to spend on someone whom we’re not going to spend the rest of our lives with.

A lot of singles in their mid and late 20s go into their first date hoping that it’ll be their last first date. We’re no longer dating to date, but we’re dating for marriage. I’ve even heard a couple of my singles friends tell me, “I want my next boyfriend to be my last one.”

Sophia, 25 and single, shared how she goes into every first date subconsciously analysing everything about her date, to get a sense of whether she sees herself spending the rest of her life with him.

“First dates used to be about having a good night out while getting to know someone,” she shares. “Now I find myself thinking about stuff you’d usually only start thinking about after knowing someone for a couple of months like “Does he want kids?” and “How religious is he?””

As much as it stinks for people like Sophia, who thought dating would be “fun and enjoyable”, buying a house in Singapore means having to think about our future a lot quicker.

It's not a bad thing to date with the purpose of marriage of course, but it may not necessarily be a good thing to be bogged down by the practicalities of what is seemingly a talk for much later on. While applying for a BTO is a great way to get us to plan for our future early, it also, in a lot of ways, ruin romance.

IS OUR HOUSING SYSTEM A CURSE?

But it’s not just the singles who are stressed out. Couples are having to commit to the person they are with a lot earlier in their relationship. And while that’s not exactly a problem, it does provide immense pressure to someone who's not ready for that level of commitment, while facing their partner who is.

No longer do we have ample time in our hands to enjoy the ‘honeymoon phase’ of a relationship. While there are the lucky few who stay with their school sweethearts for 10 years, a lot of us only find “the one” somewhere in our mid 20s.

But there are instances where despite having your lives planned out together, relationships simply don’t work out.

What happens when you have a BTO on your way, and you realise that you can no longer see a future with the person you are with?

I was surprised to find that there wasn’t a lack of post-BTO breakup stories within my circle of friends alone.

Alvin, 27, went through a breakup with his girlfriend of four years after they had successfully balloted for their home last year.

“She said that she didn’t see a future with me anymore and just needed some time for herself,” he shared. “It was later that I found out there was another guy.”

“I guess no matter how much you plan for something, sometimes life just kicks you in the nuts,” Alvin laughed.

A breakup was the last thing he had expected to happen, especially at a stage of his life where he thought he had his future all planned out.

What makes BTOs all the more scary are the implications that cancelling your application causes.

There’s no doubt that you end up forfeiting the money that you’ve invested, depending on how far along in the process you are.

You also lose your first-time applicant advantages, and if you want to apply for a BTO with your next partner, or as a single, you have to wait at least a year to be able to do so.

“It sucks that the implications of forfeiting a BTO are so costly, literally,” Alvin says. “But at least it’s taught me to take my time and not rush into settling down with someone.”

Samantha, 25, whose boyfriend also broke up with her after applying for their BTO together, believes that a BTO is an expectation created by society.

“Instead of asking, 'Proposed already ah?', people ask, 'BTO already ah?' which I think indirectly gives couples a lot of pressure to get a BTO.”

It seems like we assume getting a BTO guarantees a relationship. But there rarely is ever a guarantee on anything.

“A lot of couples rush into getting a BTO because they think that might give them some ‘security’”, she shared. “But that shouldn’t be case, you should apply for a BTO because you’re secure about your relationship.”

SOMETIMES YOU JUST WORK THROUGH IT

It’s normal to feel unsure about your relationship and stumble onto rough patches along the way. The stress that comes with the BTO doesn’t help either. What was meant to be a significant part of a couple’s life has become a stressful endeavour instead.

Couples who have successfully gotten their house have had their own share of rough patches along the way. But these couples found a way to set things on track to start building their future with their partners.

Mabel, 28, who has now secured her home through Sales of Balance (SFB), wasn’t sure if she was ready to commit to her boyfriend of 3 years before they applied for it in May 2018.

“I didn’t know if I was ready to commit,” she shared. “Because it’s not only about committing to a house, but committing to the rest of my life ahead of me.”

“Whenever we spoke about applying for a BTO, a part of me wanted it, but the other part was also scared.”

Today, Mabel and her fiancé have the keys to their house, and will be getting married in a few months' time.

“When I told my fiance about my fears, we talked about it and decided to make it work together,” she continued. “I saw his efforts in trying to make our relationship work and I just wanted to do the same.”

For Alexa, 25, applying for a BTO was a natural next step in their relationship. When they applied for their BTO, they had been together for two years and knew they were ready for the commitment.

Yet, it was after they were successful in their ballot that Alexa’s relationship hit a rough patch.

“That ‘ready’ feeling became very different as we went through a seriously rough patch that really made us think if we should move forward,” she shared.

Like anyone else in her position, Alexa didn’t want to go through the hassle of withdrawing their application.

“There was definitely a lot of pressure because this was an investment we had gotten ourselves into.” she continued. “This really showed me that the BTO system can really be a burden.”

While in many ways, having a BTO on the line does encourage you to make things work with your beau and give your relationship another chance, it doesn’t allow you to consider your relationship rationally.

“We had to tell ourselves to consider the future of our relationship as if there was no BTO involved,” says Alexa. “Because we knew that if we let the BTO decide our future, we wouldn’t be happy.”

Fortunately, Alexa and her boyfriend managed to get past their rough patch and are eager to start their life together today.

DON’T JUMP THE GUN

It’s normal to have the urge to jump on a bandwagon that everyone around you is on. We all want to have a great home by the age of 35. We all have an ideal ‘plan’ of where we want to be by the time we’re in our late 30s.

Despite being single for the past two years, Jason, still has no qualms about rushing into a relationship at 27.

“I get that in Singapore, settling down with someone takes a lot more time. But I would much rather wait until 35 and get my bachelor pad than get a BTO with someone I'm unsure about,” shares Jason. “Singlehood doesn’t scare me, being with the wrong one does.”

BTOs should be a mere stepping stone into the future you want to build, it shouldn’t be the foundation of it.

“Your future shouldn't depend on getting a BTO,” says Alexa. “It’s better to be 30 and single than to be with someone you’re unsure about.”

Also read: Hustle Together, Stay Together - These Singaporean Couples Prove That Office Romance Can Work

GIF from GIPHY

The fact that it is such a foreign concept also made me think of the worst that can happen, and I sure as hell didn’t want to end up bankrupt from uninformed investment choices at such a young age.

GIF from GIPHY

The fact that it is such a foreign concept also made me think of the worst that can happen, and I sure as hell didn’t want to end up bankrupt from uninformed investment choices at such a young age.

So How Did People Actually Get Into It?

Curious to see how some of my peers got started in their foray, I checked in with two of my friends who’ve invested in some stocks since their early twenties. Exactly like how many of us who haven’t started investing would feel, the main struggle that 26-year-old Daniel faced when he started investing at 20 is finding the initial courage to do it. Fortunately for him, a degree in finance and capital from a father who is quite an avid investor gave him a head start. For the rest of us who aren’t that lucky in that sense, it’s hard to start because we don’t even know what we don’t know - which is pretty much the most helpless state one could be in. GIF from GIPHY

However, like what DollarsAndSense.sg wrote in an article about investing with just $100 a month in Singapore, “Setting aside a large sum of money and acquiring extensive knowledge before you actually start investing is not only unnecessary and impractical, it may not even be the ideal situation.”

As for 26-year-old Billy who paid to learn from investment courses, his challenges were figuring out what stocks to buy and which platform to use when he first got started at 22. And it was a nerve-wrecking process of trial and error before he got the hang of things.

Even for Daniel and Billy today, they still find themselves lacking time to monitor their investments.

That’s where technology like the new robo-investing service comes in.

GIF from GIPHY

However, like what DollarsAndSense.sg wrote in an article about investing with just $100 a month in Singapore, “Setting aside a large sum of money and acquiring extensive knowledge before you actually start investing is not only unnecessary and impractical, it may not even be the ideal situation.”

As for 26-year-old Billy who paid to learn from investment courses, his challenges were figuring out what stocks to buy and which platform to use when he first got started at 22. And it was a nerve-wrecking process of trial and error before he got the hang of things.

Even for Daniel and Billy today, they still find themselves lacking time to monitor their investments.

That’s where technology like the new robo-investing service comes in.

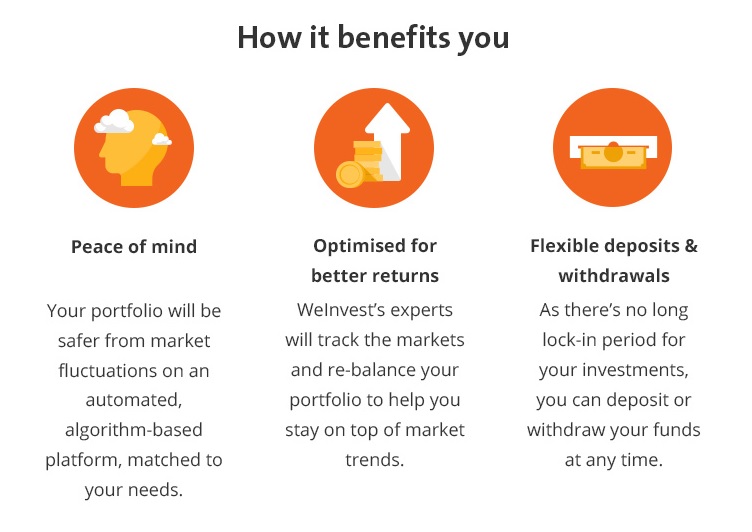

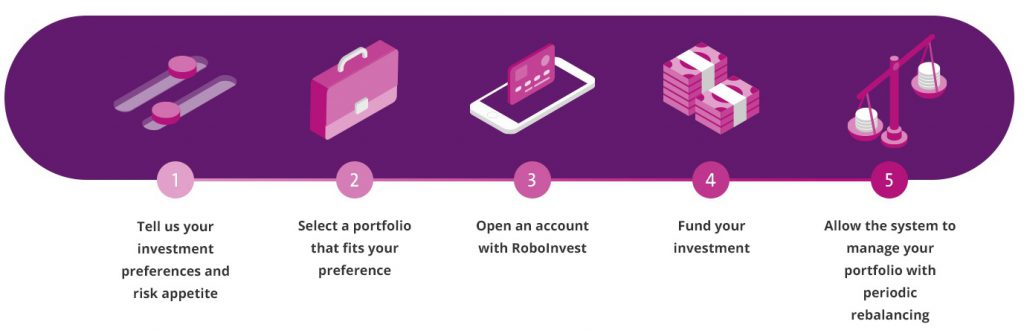

A Gem For Beginners And The Time-Starved

As the name suggests, robo-investing works like a virtual consultant and is basically an online investment advisor that uses algorithm to monitor your investing portfolio. The automated digital investment platform will help match your needs and preferences to portfolios best suited for you. In other words, your ‘digital assistant’ will recommend portfolios to you so you can get the best possible returns. One such robo-investing service available in Singapore is OCBC RoboInvest. Whether you’re new to investing or want to invest but are too busy to do so, OCBC RoboInvest helps you invest and grow your savings with minimum effort. The first of its kind offered by a bank in Singapore, it’s an investment platform that lets you choose your preferred portfolio and uses algorithms to track and rebalance your investment portfolios, with your approval.

1. Not having enough money

My greatest fear is not having enough money to support myself. Without money, I wouldn’t be able to afford basic necessities like food and water. Even public transport will be inaccessible for me. Plus, I don’t like to rely on other people. If I have no money, I’ll have to go around borrowing money from others and I personally hate doing so. - Melissa, 272. Not living up to expectations

Since young, many people have told me that they see a lot of potential in me. Be it doctor, lawyer, or a successful businessman, they are convinced that I’m going to do great things. Because of that, I’m always fearful that I’m not going to reach that level of potential that they’ve set out for me. Thus, I always push myself to work hard everyday so that I’ll be able to match up to their expectations of me. - Daniel, 263. Settling for an unfulfilled life

In Singapore, a lot of emphasis is placed on financial success. My parents want me to have a corporate job so that I’ll be financially stable, but that’s not where my passion lies. So I made a promise to myself to ‘sell out’ and settle for something else instead of chasing after my passion. - Edirina, 204. Losing my loved ones

As a mother of two, family means a great deal to me. I had my first child when I was just 19 and it has taught me so much about love, patience, family and compromise. I’m really grateful for my parents, my husband, and my two little girls. I can’t imagine life without any of my loved ones. - Esther, 265. Getting kicked out of home for coming out

As with most asian families, my mom is conservative and fierce (aka tiger mom). As much as I love her and am thankful for her bringing me up all these years, I’m afraid of coming out to my family as I don’t want to risk getting kicked out. I’m not sure that their love for me will be able to overpower the disdain they have towards more liberal ideas. - Scott, 256. Self-imposed Inadequacy

My parents are super chill and they let me do whatever I deem fit. Because of that, I’ve always had really high expectations of myself as I feel that if I don’t take control of my own life, no one will. Further fueled by my own insecurities, the thought of being inadequate in any sense, be it at work or life in general, just doesn’t sit well with me. - Zul, 247. Being judged

Back in primary school, I was always afraid of getting called to answer a question in class as I was afraid that if I get the answer wrong, people would laugh at me and make nasty comments about me behind my back. I would get anxious easily and sometimes, that stops me from doing the things that I like. Because of my anxiety, I would always be afraid that people are judging me, even if they aren’t. - Anna, 258. Not going to heaven

Whether you’re religious or not, I’m pretty sure that you know what Hell is about: basically, a lifetime of torture. I wouldn’t want to end up going to Hell because I don’t want to suffer and be tortured for the rest of my life. I can’t even handle life, how am I supposed to handle Hell?! In my religion, we believe that Heaven is a really great place to be at. So I want to end up there when I die and just enjoy. - Matthew, 219. Losing my arms

I’m a designer and an avid gymmer so my physical body parts mean alot to me. Thus, I would say that my greatest fear is losing my arms as that will mean that I can’t do the things that I like anymore. I can’t imagine living life without designing, drawing, painting, and weightlifting. - Jan, 2610. Death

I fear death as it means that the whole world will continue to go on without me after I’ve passed and I’ll be non-existent and slowly forgotten. I also fear the unknown. None of us truly knows what is going to happen after we’re dead, and that scares me. - Shi Ling, 2711. Dying alone

I’m a romantic. I believe in ‘The One’ and I yearn to meet someone whom I’m able to connect with on all wavelengths. So I’d say my greatest fear is not being able to find someone that can stimulate me both intellectually and emotionally and I’ll die alone, with nobody to love and no one to love me back. - Mabel, 2212. Never being able to love myself

As a child, I was overweight and ugly. I would get picked on by my peers and my parents would make insensitive comments about my appearance. I wasn’t taught how to love myself and I grew to be my own worst critic. Till now, I struggle with low self-love and I can’t seem to be comfortable in my own skin. I guess my greatest fear would be that I will never be able to learn to love myself for who I am till the day I die. - Alethea, 2113. Losing control of myself

Not having control over my own life and decisions, be it consciously or physically. Maybe I’ve been watching too much ‘Black Mirror’ but I imagine not being able to control my own thoughts or actions and that’s so scary! - Alanna, 2214. Being the same as everyone else

As I grew up in a family where sibling rivalry is ever present, I always pride myself in being different from my sister so that my parents wouldn’t compare us as much. I think that led me to always strive to be different from everyone else. - Melodie, 2015. Not being able to make it

It’s very competitive in the Arts industry so I’m always pushing myself to learn more and create things that are fresh and unique. I really want to be an Artist and I can’t foresee myself doing anything else, so my greatest fear would be not succeeding in the field that I’m passionate about. - Karen, 20Not Just Young And Nonchalent

After speaking with these millennials, I realised that many of us have very practical concerns. Most of us just tend to keep our concerns to ourselves as we’re afraid that our worries will be deemed insignificant because of our young age. But that shouldn’t matter. Be it age 18 or 35, we’ve all got our own set of worries and problems that we have to deal with. We might be young and throwing around phrases like YOLO and ‘live fast, die young’ but our worries don’t just consist the common irrational fears and superficial wants, many of them stemmed from our upbringing and culture. So here’s the age-old question I’m throwing back at you, what’s your greatest fear and how do you deal with it? Share with us in the comments below! Also read, 8 Singaporeans Shared Snapshots Of What Depression Was Like For Them.WHAT IS THE PINK TAX?

The Pink tax is the proven theory that women pay more for everyday things branded 'for women' than men do, such as women's shampoo, women's razors, and women's hair gel. The pink tax is not particularly a ‘tax’ per se. It’s not like someone deliberately decided that women should have to pay more for their items than men. Have you ever come across a product that came in a pink packaging and was labelled 'feminine'? The pink tax comes from the fact that companies charge more for a women’s version of products because they are supposedly ‘women-friendly’. No one really knows how much truth there is to that. For instance, products like deodorants for women are said to be more ‘sensitive’ and because of that, they somehow cost more. Products like sanitary pads and tampons, in many cases, are considered luxury products. For obvious reasons, these products don’t have male versions. But that doesn’t take away from the fact that they are a necessity for women, yet are victim to sales tax. Having bought women-specific products myself, I recall looking at a shelf of hair products and realising that two identical hair gel products (one for men and the other for women) had two separate costs. Imagine paying an extra dollar for the same brand and quantity of a tube of hair gel than your male counterpart, it doesn't really make much sense.EARN LESS, PAY MORE

Many women today are choosing to opt for men's products instead. Think about a men’s razor, now think about a women’s razor. What’s the difference? Chances are you wouldn’t find any. Well, besides the colour. Not too long ago, Run Society wrote a piece on how women runners in Singapore spend more than men because the sports essentials for women runners cost more. In the piece, Run Society references The Ministry of Manpower Labour Force’s 2015 report, which states that most women only get paid as much as men until they hit 30, after which they get paid less. It’s no surprise that women fall behind at the workplace. Statistically, Singapore ranks higher than its neighbours in the global gender gap scale. But according to a report by The Economist’s Intelligence Unit, Singaporeans feel the presence of a gender bias more strongly. Apart from the wage gap, one of the key issues in the gender gap is the lack of women in senior management positions. According to The Economist’s Intelligence Unit's report, just 26% of senior executives are estimated to be women in Singapore. That’s lower than the 32% in Malaysia and 34% in Indonesia. If we were to compare these numbers with places like the USA, where 78% of women felt that women are under-represented in leadership positions, it would seem that women in Southeast Asia are less aware of the problems in gender diversity.HIDDEN PRESENCE

The fact that the pink tax is not really known to many; women included, could mean that it doesn't affect us largely on a daily basis. But if you count every dollar or every cent extra that women pay, it could amount to a lot. If you're still unconvinced about the presence of the pink tax, the next time you visit personal care stores like Guardian or Watson’s, have a trip down an aisle and compare the male and female version of products. You might be surprised with what you find. Top Image CreditCopyright © 2023 GRVTY Media Pte Ltd (Co. Reg. 201431998C). All Rights Reserved.